In a recent opinion piece on President Trump’s tariffs, I concluded that the president’s assurances to restore Joe Six Pack are simply empty promises, and the trickle-down-benefits for the middle class are mere tokens or non-existent.

Moreover, that history is repeating itself where the economic fallout of the tariffs and now the Big Beautiful Bill are falling disproportionally on middle-income families. And, by the time an exhausted middle class wakes up, most of the damage will be done.

The Big Beautiful Bill has validated my misgivings, but I see even greater inequities set in motion by future tariffs. Simply, these tariffs are beyond wrongheaded economic policy but are blatant attempt to further tax middle class for his lame duck agenda.

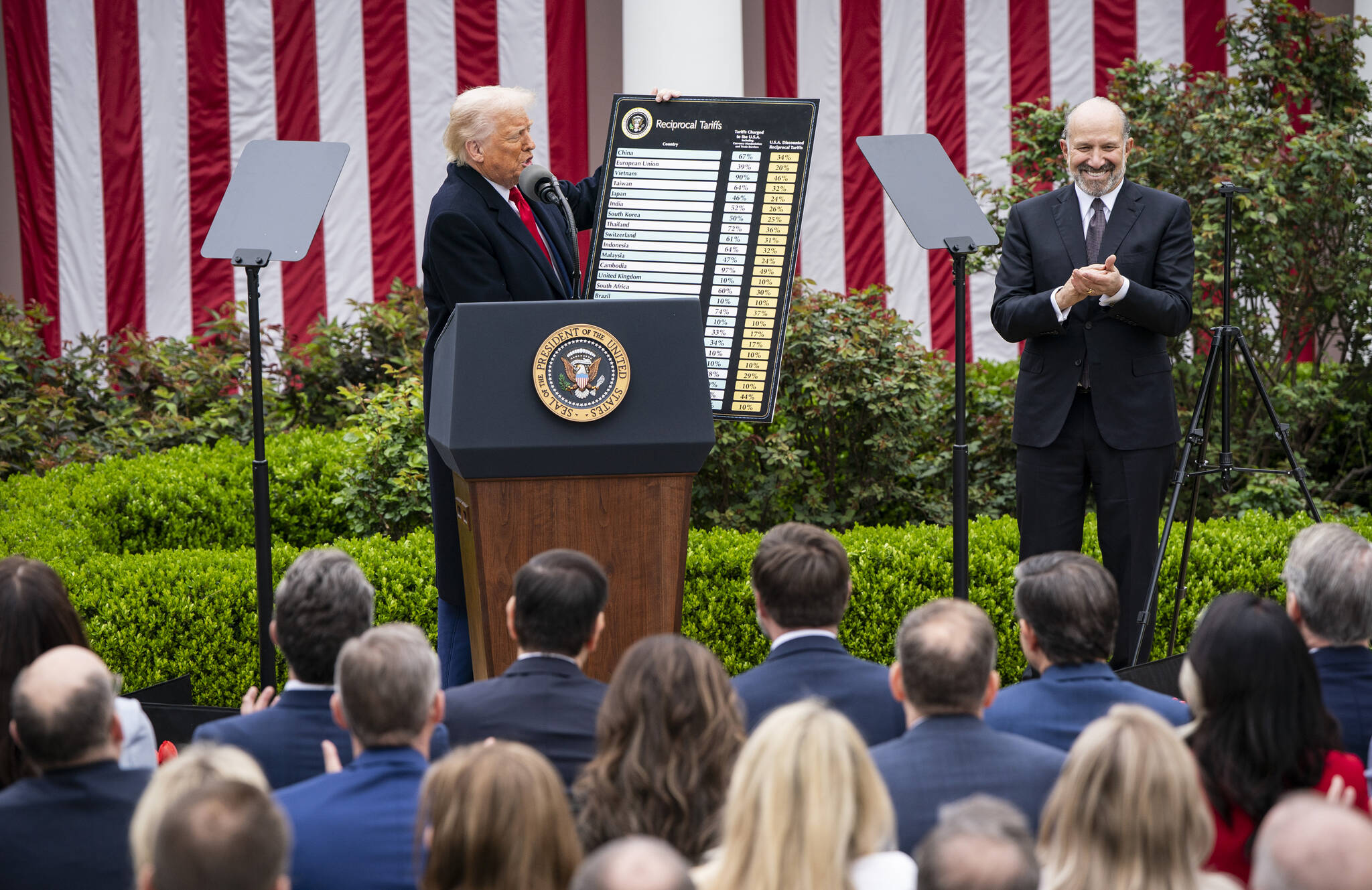

The president is focused on tariffs because he alone has this authority and he can tout misinformation about how tariffs work. Tariffs are levied and paid by the U.S. importers. The money is deposited into the U.S. Treasury and show up as new revenue. The importer can either eat the tariffs and lower profits or pass off the added costs to consumers by raising prices.

The trick is just how much of the tariffs can be passed off before rising prices reduce the demand (quantity purchased) for their products. That depends on how vital the imported item is to American buyers and whether there are reasonable American made substitutes. Nearly all broad-based tariffs are passed onto consumers.

So, whatever increase in tariffs the president can get away with, he will claim it’s new revenue but will be silent on the fact it is actually just a new federal sales tax on U.S. consumers — and hitting the middle class the hardest.

The tariffs and Big Beautiful Bill set in motion staggering tax inequities. The temporary 2017 tax cuts were primarily for the wealthiest Americans and remain unpaid but are now permanent. This adds $3-$5 trillion to the national debt and will saddle our grandchildren with a much lower standard of living.

The middle class tax cuts are no taxes on tips or overtime wages, plus seniors get a break on some Social Security benefits. By any measure, the middle class tax breaks are minuscule and will sunset in three years, while the rich tax breaks remain exorbitant, unprecedented and permanent.

Moreover, Trump Republicans could not resist in overturning the health care advanced by the Obama and Biden Administrations. This has been an obsession of the Tea Party and Sen. Mitch McConnell. Remember John McCain’s infamous thumbs down, no vote on the Senate floor — that is now largely for naught.

Despite President’s Trump’s assurances of no cuts to Medicaid he hasn’t lifted a finger to help the 12 million lower income and disabled citizens that will lose their medical insurance — but only after the 2026 elections.

The outrageous takeaway is our diminished health care will now pay for President Trump’s neo private army — ICE (plus whoever?). The ICE budget will now exceed all other federal law enforcement combined. This new army trashes all norms with masked combat units in full body armor and with assault weapons. They freely roam our streets and abduct citizens and non-citizens alike. They act with impunity and without any due process of law. Plus, they now have a big bankroll to banish racially profiled victims to harsh U.S. subsidized foreign prisons. A perverse Stephen Miller dream come true.

Lastly, both Alaska senators endorsed the tax cuts. Sen. Dan Sullivan especially likes the greenlight for Alaska’s oil industry and the increases in military spending. In contrast, Sen. Lisa Murkowski disliked the bill but traded her vote for temporary Alaska carve-outs — even whaling captains now get a tax break.

Sen. Sullivan will surely offer another word salad to rationalize the inevitable losses to rural Alaska, but it is Sen. Murkowski who carries the biggest political burden. Simply, she could have been a McCain but chose to be a Miller. So maybe Mitch has got it right when he said — they will just get over it.

Joseph Mehrkens is a retired forest economist living in Juneau and Petersburg.